Once the province of American tech hubs like California’s Silicon Valley, venture capital has gone global. Global venture capital investment amounted to $42 billion dollars in 2012, spread across more than 150 cities and metro regions around the world. The United States accounts for nearly 70 percent (68.6 percent) of total global venture capital, followed by Asia (14.4 percent), and Europe (13.5 percent).

But venture capital investment is concentrated and clustered in a relatively small number of cities and metros worldwide. The top 10 metros account for approximately 52 percent of global venture investment, the top 20 metros account for almost two-thirds, and the top 50 more than 90 percent.

These are some of the key findings of Rise of the Global Startup City a new Martin Prosperity Institute study by Richard Florida and Karen King. The report uses detailed data from Thomson Reuters to examine venture capital activity across the world, identifying and mapping its leading global centers across North America, Europe, and Asia.

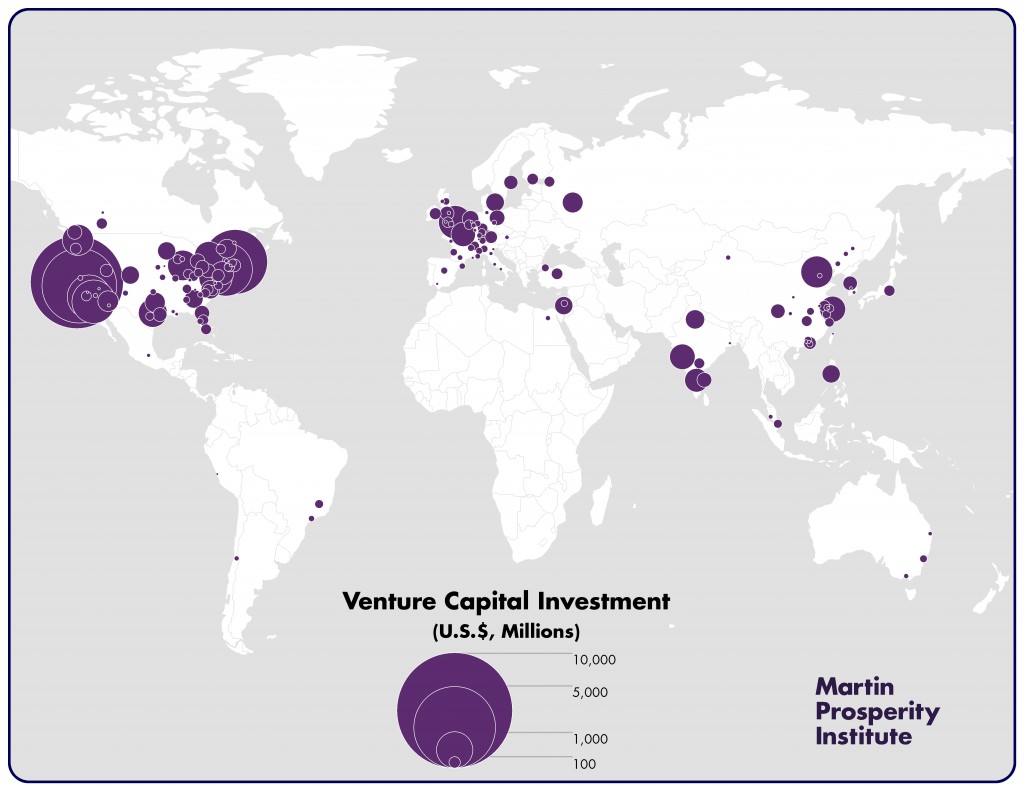

The map below charts the leading centers for venture capital investment across the globe. The largest dots indicating the largest levels of venture capital investment are located on the East and West Coasts of the United States, in Western Europe and around the mega-cities of China and India.

The United States is the world’s dominant center for venture capital — home to the top six metros and 12 of the top 20. Just six U.S. cities — San Francisco, San Jose, Boston, New York, Los Angeles, and San Diego account for nearly 45 percent of total global venture capital investment.

That said, a number of significant venture capital hubs exist elsewhere around the world. London, with $842 million, is the world’s seventh largest venture capital center. Toronto ($628 million) is 12th, and Paris ($449 million) is 16th. China and India are each represented by a pair of metros. Beijing ($758 million) and Shanghai ($510 million) are ranked ninth and fourteenth while Mumbai ($497 million) and Bangalore ($419 million) are 15th and 17th.

While there is some overlap between the world’s leading venture capital centers and its most powerful global cities, the two are not identical. New York, the world’s most economically powerful city, is fourth for venture capital investment. Conversely, greater San Francisco, which is far and away the world’s leading venture capital center, only ranks as the world’s 23rd leading global city. Twelve of the world’s leading cities rank among the top 25 venture capital centers. Fifteen of the top 25 global cities rank among the world’s top 60 venture capital centres.

Taken together, just two broad regions — the San Francisco Bay Area and the Boston-New York-Washington Corridor — alone account for more than 40 percent of global venture capital investment.

Global venture investment is highly uneven and spiky — concentrated in a small number of leading cities and metros around the world.

Download this Insight (PDF)